Financial

Roadmap

A clear, personalised path to your financial goals.

Committing to a savings plan early in life is one of the key components to building wealth and reaching your financial goals. It’s also a lot easier to achieve than you might think.

Right now, finding extra cash to save each month might seem difficult or perhaps even totally undoable. Maybe you feel the amount you can save regularly now is so small it won’t make any impact on your finances in the long-term. It’s time to challenge that mindset. Starting to save now – even with a small amount – can make a big difference down the track.

Stick with us – we’re going to show you how committing to a regular savings plan has the potential to safeguard your financial future.

Compounding is a powerful investment tool, especially for young investors. It’s a force to be reckoned with when it comes to wealth building as it helps your initial investment grow over time.

Compounding is generating more returns by reinvesting the return on your asset. Compound returns are exponential so your return increases incrementally over time.

You could think of compounding as your reward for saving consistently – it’s essentially interest on your interest. When you start saving early you create the potential for increased returns simply by holding your investment longer.

You decide to put $10,000 into a diversified long-term investment. Let’s assume that the return over the period averages out to 6% per annum.

As you can see, just by letting your investment roll over each year the incremental increase on your return becomes more significant over time.

| Year | Compound return | Total |

| 2019 | $10,000 x 6% | $10,600 |

| 2020 | $10,600 x 6% | $11,236 |

| 2021 | $11,236 x 6% | $11,910 |

| 2022 | $11,910 x 6% | $12,625 |

| 2023 | $12,625 x 6% | $13,382 |

| 2024 | $13,382 x 6% | $14,185 |

| 2025 | $14,185 x 6% | $15,036 |

| 2026 | $15,036 x 6% | $15,938 |

| 2027 | $15,938 x 6% | $16,895 |

| 2028 | $16,895 x 6% | $17,908 |

| 2029 | $17,908 x 6% | $18,983 |

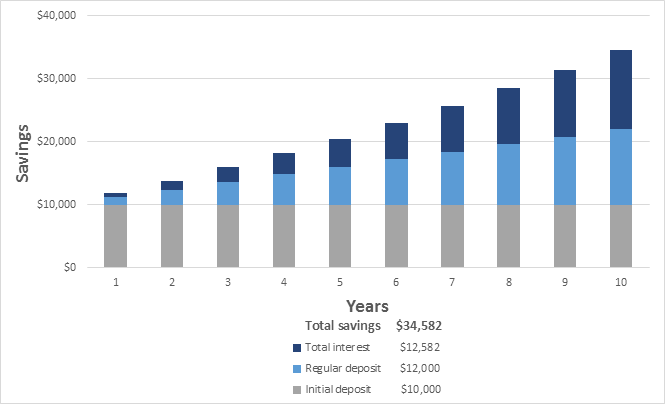

Here’s what that investment would look like if you added $100 in savings every month.

In this example, you can see that after 10 years the total interest earned is actually greater than the regular amount that has been put in. Starting your savings plan early allows you to harness the long-term benefits of compound returns.

Time is a key factor in wealth building. Given the time value of money, we know that one dollar today is worth more than one dollar in the future.

The numbers below tell the story of why it’s so important to start saving early in life.

Let’s set a goal of accumulating $500,000 by age 60, assuming an annual return of 6%.

To achieve this goal a 25-year-old would need to invest $351 a month.

A 35-year-old would need to invest $722 a month. And a 45-year-old would need to invest $1,720 a month.

As you can see, the 45-year-old must invest more than four times the monthly amount to reach the same goal as the 25-year-old.

Starting to save when you’re younger allows you to take advantage of compound returns. While you’re working hard so is your money and this can be especially helpful when you’re planning for retirement.

If you find it difficult to save, start by setting a realistic, achievable, short-term savings goal. This can motivate you to form a long-term savings habit.

Commit to saving for something that will deliver a tangible result. Maybe it’s your next holiday or a little luxury that you wouldn’t usually splurge on. Setting up a direct deposit can be very effective as once it’s operating the withdrawals and deposits happen automatically – you don’t miss what you don’t see.

Once you’re in the regular habit of putting money aside, saving for the long-term becomes part of your financial life.

A financial adviser can help you create a savings plan that takes into account your current circumstances and builds toward your long-term financial goals.

Savings accounts are an obvious choice, but there are other options that may deliver better returns and be more suited to your individual circumstances.

Topping up your super with regular contributions can be an excellent option as it offers the benefits of long-term compounding growth in a low tax environment. The little extra you put in now can help pay for those big-ticket items in retirement.

You could also consider growing a nest egg outside of super by establishing a personally held, diversified investment portfolio.

This allows you to benefit from compounding even further by reinvesting your dividends or distributions back into the share market. This incremental increase in your investment can have advantages as part of a long-term strategy.

Cash flow is another benefit of committing to a long-term savings plan.

It might sound a little counter-intuitive at first, but as we saw in the examples above if you start saving early your regular commitment is less.

Compounding helps your money work harder so you can enjoy life now and in the future.

If you plan correctly, you can have more in your pocket today and be in a stronger financial position in the future.

When cash flow is tight it can be tempting to dip into your savings account or pop that extra expense on your credit card.

But the long-term effects of sacrificing your savings can be significant.

Regular long-term saving is the key safeguarding your financial future.

Don’t be fooled into thinking you’ll be able to make up today’s saving by contributing more later on.

Retirement might seem a long way off right now, but life moves at a frantic pace.

The earlier you start planning, the more opportunities you’ll have to build wealth along the way.

A trusted financial adviser can provide industry expertise and market intelligence so you can make decisions that match your investment goals.

At First Financial we firmly believe that a long-term strategy is the best way to build wealth.

Committing to a regular savings plan that unleashes the benefits of compounding is another example of the many advantages of long-term planning.

We’ve also discussed the benefits of a long-term strategy when it comes to the importance of dividends, diversification and thinking like a smart investor.

The sooner you start saving, the more time you will have to build wealth. You can’t turn back the clock, so start putting a smart saving strategy in place today. Take the first steps to safeguarding your financial future – contact First Financial. Read more Financial Planning articles.

Every client journey begins with a conversation. We look closely at where you are now, what matters to you, and what’s possible. Then we structure our advice to match.

A clear, personalised path to your financial goals.

Proactive strategies to maximise your tax savings.

Tailored plans aligned with your goals and risk profile.

Regular guidance to keep your plan on track.

Retired and semi-retired

Referred by friends who were helped through aged care, Craig sought secure financial guidance after inheriting funds.

“We feel very secure with First Financial, the income just comes in, and we know everything is being looked after. It’s not just safe, it’s smart. We’ve recommended them to others because we genuinely believe in the team.”

Early retirement and working professional

When Tim received an overseas medical settlement, he and Adam had just 14 days left in a 90-day window. They needed clear guidance, fast. A referral led them to First Financial.

“We’re in totally different life stages, but First Financial built a strategy that supports us both. From urgent legal steps to ethical investing, they handled every detail with calm, care, and real expertise. It’s financial freedom without compromise, and we couldn’t have done it without them.”

Newly retired

As retirement neared, Larry and Virginia were ready to enjoy travel, family, and freedom, without uncertainty. A friend recommended First Financial, and from the first meeting, they had a clear plan, a safety net, and people they trusted.

“We’ve travelled the world, Europe, Sri Lanka, Vietnam, without once stressing about the money. They made everything feel simple and gave us the confidence to live well. We feel secure because we know exactly where we stand, and that peace of mind means everything.”

Retired business owner

After decades of running a successful pharmacy, John sought financial guidance to simplify decision-making and support long-term planning.

“I feel genuinely supported by First Financial. I can ask anything, and there’s no pressure, just clear advice and real care. The money’s growing, I’m not stressed about it, and I feel completely at ease for the first time. I don’t miss work, but I’d miss the support I get from First Financial.”

Retired widow

Lyn stepped into financial management for the first time after her husband's passing. With patience and care, First Financial supported her through grief, learning, and empowerment.

“After my husband passed, I was completely unsure where to start. First Financial gave me the space to learn, to ask questions, to grow confident. They drew a diagram that I still have. And now, I sleep well at night knowing I’ve got someone in my corner.”

Retired

Jan's husband managed the finances until entering aged care. Jan gradually stepped into the financial picture with First Financial’s support.

“The money just comes in. I don’t have to think about it. And I know they’re always there. They’ve always been there in the background, just quietly making things work.”

You can use the form below to make a general or initial enquiry.

You can also book a 15-minute call with an adviser by clicking the blue button below.

You can use the form on the right to make a general or initial enquiry.

You can also book a 15-minute call with an adviser by clicking the blue button below.

Fill in your details and briefly let us know how we can help.

We’ll reach out to schedule a time that suits you.

Enjoy an obligation-free initial meeting to discuss your goals and explore how we can guide you toward financial confidence.

Let’s start the conversation.

We look forward to hearing from you!

Level 9, 90 Collins Street,

Melbourne, VIC, 3000

Office Hours

Mon – Fri | 9:00 am – 5:00 pm