Financial

Roadmap

A clear, personalised path to your financial goals.

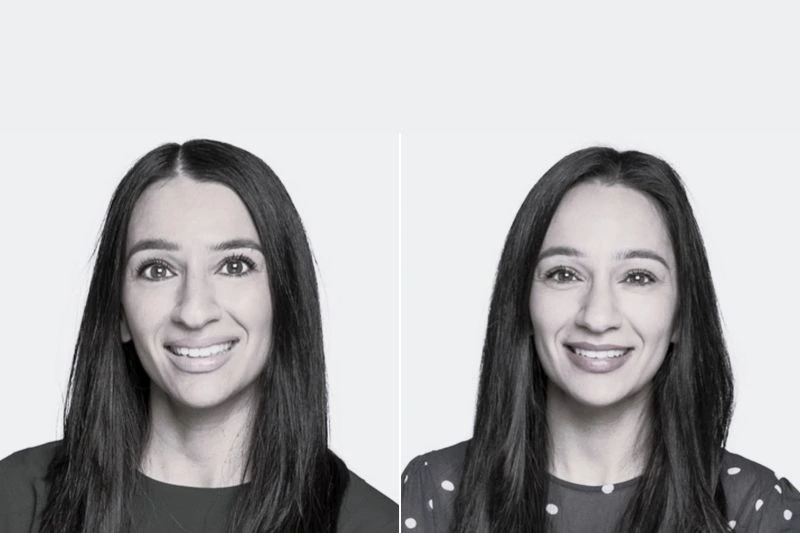

In some offices, you might overhear a familiar voice. In ours, you can sometimes hear the same one twice because there really are two of them. Meet Stef Falleti and Nicole Gullone, identical twins and trusted financial advisers.Their mirrored career paths and subtle differences are all part of how they show up for their clients and contribute to our successful team.

At First Financial, our advisers combine technical expertise with authenticity and genuine care for the people they serve.

As you will see from Stef and Nicole’s story, building meaningful relationships is not just part of the role, it is what makes this career deeply rewarding.

Nicole and Stef never expected to build identical careers at the same firm, but life has a way of ignoring careful plans. While studying accounting, they took an elective in financial planning that changed everything. Nicole remembers the moment clearly: “We looked at each other like, this is actually practical information that could help Mum and Dad.” That motivation to help their own family grew into a commitment to guide others through some of life’s most important financial decisions.

When it came time to apply for graduate roles, they agreed to target different companies to avoid competition and confusion, with one exception, First Financial’s predecessor. Stef applied for an accounting position, and Nicole applied for a wealth management role. As it turned out, the accounting positions were already filled, so Stef was redirected to the wealth interview, the same group session as her sister. Stef laughs, “We sat on opposite sides of the room thinking no one would realise we looked exactly the same, but it didn’t take long.”

They were both hired, and the rest is history. Twins on a shared vocational path. First, they gained experience through vacation and graduate programs before moving into the client service team. From there, each learned more about the profession while under the direct mentorship of a principal as an associate adviser. By 2018, they had earned their adviser titles and have been doing exceptional work ever since.

For good financial advisers, financial planning is never solely about the numbers. Of course, the figures matter, but their meaning comes from understanding the person across the table. Nicole and Stef recognised this from the very beginning.

Over the years, Nicole and Stef have become trusted confidantes for many of their clients, often stepping into moments that have little to do with spreadsheets or strategy. Nicole recalls visiting an elderly client who lives alone: “Most of the meeting is her sharing what’s been happening over the last six months because she doesn’t have many opportunities to talk to other people.

These small gestures can make a significant difference in someone’s life. It’s not just about supporting their financial journey, but also understanding what is really important to them.”

Stef feels the same way. She says, “Most meetings start with a life update. Many of my clients have seen me marry and have kids. We’re growing together.” That level of familiarity helps clients trust her when decisions get complicated. “Knowing their goals and how they want to live is what drives our strategies. You can be the smartest person in the world, but if you can’t talk to someone and build that trust, it’s never going to work.”

Both women emphasise that trust takes time. Over more than a decade at First Financial, they have become the first call for many clients facing illness, loss or unexpected changes. Whether it is a quick check-in or a complex strategy, their focus is always on the client.

Stef remembers answering her phone on her day off while at the park with her children and realising a client was moments away from being scammed. She acted quickly and stopped the fraud before any money was lost, but the whole experience was a reminder of how important it is that clients know they can turn to her in urgent moments.

Stef and Nicole credit First Financial with creating an environment where advisers can build long careers without sacrificing their lives outside work. Over the years, they have been part of a group of colleagues who have experienced life and career growth together, from promotions to marriage, parenthood and beyond. This has created a workplace culture that celebrates shared milestones and fosters genuine understanding.

Nicole recalls returning from maternity leave with gratitude for her career and team. “They were so flexible. It was comforting knowing I could step back in smoothly,” she says. Being able to return part-time lifted a great deal of pressure during a demanding and vulnerable stage of life and reaffirmed her value as a professional and her ability to balance parenthood.

Stef had a similar experience. “Our leadership understands the juggle of young families. We have built systems so clients are supported even if we are part-time,” she explains. She says that kind of planning shows the business values both its people and the continuity of service that clients depend on.

Finance has traditionally been a male-dominated profession, but Stef and Nicole believe women can bring a unique perspective. “Being female often allows for more emotive conversations, which for me, helps understand clients on a deeper level,” says Nicole. She adds, “Discussing financial matters can be quite intimidating and make people feel vulnerable, so allowing for a safe space to open up allows for a more meaningful discussion.”

Together, their experiences show how different communication styles create a more rounded approach for clients. Having advisers with varied life experiences and perspectives means clients can connect in the way that feels most comfortable to them, while still receiving the same high standard of advice.

Working together, and at times stepping in for each other during maternity leave, has worked well for Nicole and Stef for more than a decade. “Following the same career path has provided us many unique opportunities which we don’t take for granted. We have been able to leverage off each other to learn and grow and build our individual client bases”.

What began as an elective choice has now unravelled into two highly successful careers at First Financial. Nicole and Stef see their future much like their past. Many days ahead that involve showing up for their clients, growing alongside them, and always finding meaning in the little moments that make this work worthwhile.

If you’d like clear, practical financial advice from advisers who listen and build guidance around your priorities, contact our team today.

And if building a career in financial advice alongside supportive colleagues appeals to you, visit our careers page to explore the opportunities at First Financial.

Read more financial planning articles.

Every client journey begins with a conversation. We look closely at where you are now, what matters to you, and what’s possible. Then we structure our advice to match.

A clear, personalised path to your financial goals.

Proactive strategies to maximise your tax savings.

Tailored plans aligned with your goals and risk profile.

Regular guidance to keep your plan on track.

Retired

Jan's husband managed the finances until entering aged care. Jan gradually stepped into the financial picture with First Financial’s support.

“The money just comes in. I don’t have to think about it. And I know they’re always there. They’ve always been there in the background, just quietly making things work.”

Early retirement and working professional

When Tim received an overseas medical settlement, he and Adam had just 14 days left in a 90-day window. They needed clear guidance, fast. A referral led them to First Financial.

“We’re in totally different life stages, but First Financial built a strategy that supports us both. From urgent legal steps to ethical investing, they handled every detail with calm, care, and real expertise. It’s financial freedom without compromise, and we couldn’t have done it without them.”

Retired business owner

After decades of running a successful pharmacy, John sought financial guidance to simplify decision-making and support long-term planning.

“I feel genuinely supported by First Financial. I can ask anything, and there’s no pressure, just clear advice and real care. The money’s growing, I’m not stressed about it, and I feel completely at ease for the first time. I don’t miss work, but I’d miss the support I get from First Financial.”

Retired and semi-retired

Referred by friends who were helped through aged care, Craig sought secure financial guidance after inheriting funds.

“We feel very secure with First Financial, the income just comes in, and we know everything is being looked after. It’s not just safe, it’s smart. We’ve recommended them to others because we genuinely believe in the team.”

Newly retired

As retirement neared, Larry and Virginia were ready to enjoy travel, family, and freedom, without uncertainty. A friend recommended First Financial, and from the first meeting, they had a clear plan, a safety net, and people they trusted.

“We’ve travelled the world, Europe, Sri Lanka, Vietnam, without once stressing about the money. They made everything feel simple and gave us the confidence to live well. We feel secure because we know exactly where we stand, and that peace of mind means everything.”

Retired widow

Lyn stepped into financial management for the first time after her husband's passing. With patience and care, First Financial supported her through grief, learning, and empowerment.

“After my husband passed, I was completely unsure where to start. First Financial gave me the space to learn, to ask questions, to grow confident. They drew a diagram that I still have. And now, I sleep well at night knowing I’ve got someone in my corner.”

You can use the form below to make a general or initial enquiry.

You can also book a 15-minute call with an adviser by clicking the blue button below.

You can use the form on the right to make a general or initial enquiry.

You can also book a 15-minute call with an adviser by clicking the blue button below.

Fill in your details and briefly let us know how we can help.

We’ll reach out to schedule a time that suits you.

Enjoy an obligation-free initial meeting to discuss your goals and explore how we can guide you toward financial confidence.

Let’s start the conversation.

We look forward to hearing from you!

Level 9, 90 Collins Street,

Melbourne, VIC, 3000

Office Hours

Mon – Fri | 9:00 am – 5:00 pm