Financial

Roadmap

A clear, personalised path to your financial goals.

Becoming a smart investor is about using your head, not going with your gut feeling. It’s about making a long-term investment strategy and staying the course.

A smart investor doesn’t chase momentum – they find value.

Thinking smart means keeping a cool head and trusting in your decisions, not crossing your fingers and hoping for a short-term gain.

So how do you know if you’re getting your investment strategy right? How do you know if you’re making the best decisions for your financial future?

A good place to start is with a trusted financial adviser who has the backing of solid research and the input of investment professionals. It also helps to take a look at the kind of thinking that often informs our decisions when it comes to investing – so you can ask yourself, ‘Am I making the smart choice?’

When we bring it back to basics, investing is buying an asset today with the expectation that it will increase in value and create wealth in the future.

It’s not just as simple as picking the stock that’s getting the most attention in the media and taking a punt. That’s called speculating, not investing – and there’s a big difference.

Speculating is about buying almost any asset, often with a short-term focus and the intention of making a capital gain by selling quickly. It’s also called ‘the bigger fool theory’ – buying an asset where there is no basis for measuring its value but hoping that ‘a bigger fool’ buys it from you for a higher price. Basically, you’re taking a punt – it’s a high-risk strategy.

Investing, on the other hand, is all about buying an asset where the underlying business generates a sustainable, recurring cashflow that in turn enhances the value of that asset. It’s about patiently accumulating a diversified portfolio of quality companies that can grow their profits over time. The focus is on quality companies that both grow shareholder wealth and pay dividends over the long term.

This leads to the next question – how do you know a quality company from a fly-by-night? Let’s face it – the difference between hype and true value is sometimes hard to tell.

You’re probably familiar with the basic economic concept of the relationship between the demand for a product and its price: as prices go up, demand goes down, and as prices go down, demand increases. So, if pens are generally sold for $2 and then go on sale for $1, people will generally stock up.

It makes sense – right? It’s a concept we apply doing everyday things, like shopping for groceries.

When it comes to investing, for some strange reason, people often do the exact opposite. When prices of shares are going down, they rush to sell and when share prices are going up everyone wants to be a buyer.

It’s called momentum investing and it’s true herd mentality – buying when the market gets caught up in the hype of the latest fad, theme or boom. And when prices are down, momentum investors tend to allow fear to take hold – they sell out and often lose out.

A more effective strategy is value investing – carefully calculating fair value for a company’s shares and buying at the right price.

So, when markets are overvalued, it can be a great time to sell and take profits, and when markets drop it’s often a great time to buy quality companies that are effectively ‘on sale’.

Value investing as the foundation of a long-term investment strategy can help you stay on course through the various market cycles.

Of course, gaining the understanding and finding the time to identify investments that will retain and grow your wealth is the hard part.

This is why getting advice from a financial adviser, who brings with them a wealth of experience and industry knowledge, is a great first step.

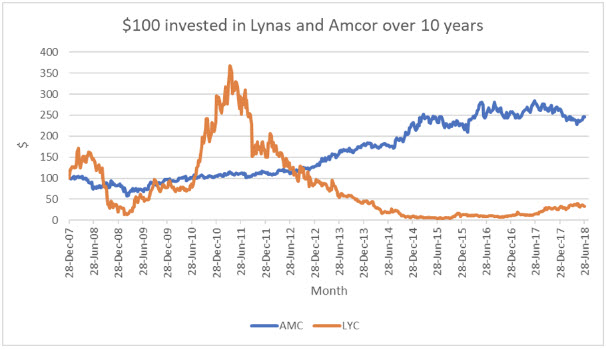

Here’s a story of two Australian companies, Lynas and Amcor, that illustrates the difference between chasing momentum and identifying value – between speculating and smart investing.

At the height of the WA resources boom, Lynas announced a plan to mine and process ‘rare earth’ for use in mobile phones and laptops. At its peak, speculators pushed the share price up to $25. As it turned out, ‘rare earths’ are not so rare and within two years the share price had plummeted to less than $1.

What looked like a sure thing suddenly wasn’t and investors who failed to bail out early took significant losses.

The second company, Amcor, is now the largest packaging company on the ASX. While its product may not sound as exciting as ‘rare earth’, Amcor’s rise has been far more successful, albeit slow and steady. Amcor has been a good investment over the last ten years. Its core business is strong enough to weather economic downturns. Strong leadership has seen the business expand globally while also paying a healthy, growing dividend to its shareholders.

As they say, a picture paints a thousand words, but when it comes to numbers, a line chart like the one below tells the whole story.

Source: IRESS, 28 Dec 2007 – 29 June 2018

The best investments provide cash flow and growth in a robust portfolio that meets your needs.

Understanding your own thinking and biases when it comes to investment can be a huge asset in making smart decisions. Here are the key takeaways to keep in mind:

● Invest – don’t speculate. Focus on quality companies with solid management that generate sustainable cash flow and have potential to add value through growth.

● Invest in value. Focus on the fundamental value of a quality company you are investing in, not just the momentum of a company’s share price.

With so many factors in play, investing is never a simple equation. At First Financial we understand making decisions about your financial future can be confusing. Our job is to structure your investment portfolio, so you can have confidence planning for the future.

Speak to a First Financial adviser for a detailed discussion about building your investment portfolio today. Read another investments article.

Source: Investors Mutual Limited, “20 lessons from 20 years of quality” www.iml.com.au/20-lessons

Every client journey begins with a conversation. We look closely at where you are now, what matters to you, and what’s possible. Then we structure our advice to match.

A clear, personalised path to your financial goals.

Proactive strategies to maximise your tax savings.

Tailored plans aligned with your goals and risk profile.

Regular guidance to keep your plan on track.

Retired widow

Lyn stepped into financial management for the first time after her husband's passing. With patience and care, First Financial supported her through grief, learning, and empowerment.

“After my husband passed, I was completely unsure where to start. First Financial gave me the space to learn, to ask questions, to grow confident. They drew a diagram that I still have. And now, I sleep well at night knowing I’ve got someone in my corner.”

Retired and semi-retired

Referred by friends who were helped through aged care, Craig sought secure financial guidance after inheriting funds.

“We feel very secure with First Financial, the income just comes in, and we know everything is being looked after. It’s not just safe, it’s smart. We’ve recommended them to others because we genuinely believe in the team.”

Early retirement and working professional

When Tim received an overseas medical settlement, he and Adam had just 14 days left in a 90-day window. They needed clear guidance, fast. A referral led them to First Financial.

“We’re in totally different life stages, but First Financial built a strategy that supports us both. From urgent legal steps to ethical investing, they handled every detail with calm, care, and real expertise. It’s financial freedom without compromise, and we couldn’t have done it without them.”

Retired business owner

After decades of running a successful pharmacy, John sought financial guidance to simplify decision-making and support long-term planning.

“I feel genuinely supported by First Financial. I can ask anything, and there’s no pressure, just clear advice and real care. The money’s growing, I’m not stressed about it, and I feel completely at ease for the first time. I don’t miss work, but I’d miss the support I get from First Financial.”

Newly retired

As retirement neared, Larry and Virginia were ready to enjoy travel, family, and freedom, without uncertainty. A friend recommended First Financial, and from the first meeting, they had a clear plan, a safety net, and people they trusted.

“We’ve travelled the world, Europe, Sri Lanka, Vietnam, without once stressing about the money. They made everything feel simple and gave us the confidence to live well. We feel secure because we know exactly where we stand, and that peace of mind means everything.”

Retired

Jan's husband managed the finances until entering aged care. Jan gradually stepped into the financial picture with First Financial’s support.

“The money just comes in. I don’t have to think about it. And I know they’re always there. They’ve always been there in the background, just quietly making things work.”

You can use the form below to make a general or initial enquiry.

You can also book a 15-minute call with an adviser by clicking the blue button below.

You can use the form on the right to make a general or initial enquiry.

You can also book a 15-minute call with an adviser by clicking the blue button below.

Fill in your details and briefly let us know how we can help.

We’ll reach out to schedule a time that suits you.

Enjoy an obligation-free initial meeting to discuss your goals and explore how we can guide you toward financial confidence.

Let’s start the conversation.

We look forward to hearing from you!

Level 9, 90 Collins Street,

Melbourne, VIC, 3000

Office Hours

Mon – Fri | 9:00 am – 5:00 pm