Planning for longer life spans

Australians in their 40s, 50s, and 60s are looking ahead to longer lifespans than previous generations. This means longer retirements to fund.

Australians in their 40s, 50s, and 60s are looking ahead to longer lifespans than previous generations. This means longer retirements to fund.

Investing for your grandchildren is one of the most rewarding gifts you can give them. This article explains some sound options.

Retirement is no longer what it used to be. We’ve been discussing the options of a phased retirement with our clients over the past few years.

When retirement is on the horizon, many couples in Australia start thinking about the aged pension. Know how the pension is calculated.

A testamentary trust can protect your children’s inheritance from unplanned mishaps like divorce or bankruptcy.

If you’re nearing retirement or enjoying it, you will be aware of inflation’s impact on everyday life. In this article, we examine inflation in retirement and what it means for everyday Australians.

Money means different things to everyone. What feels like stability to one person might feel like a limitation to another. Our values shape daily choices and big life plans, and in a partnership, the challenge is learning how to bring two financial perspectives together.

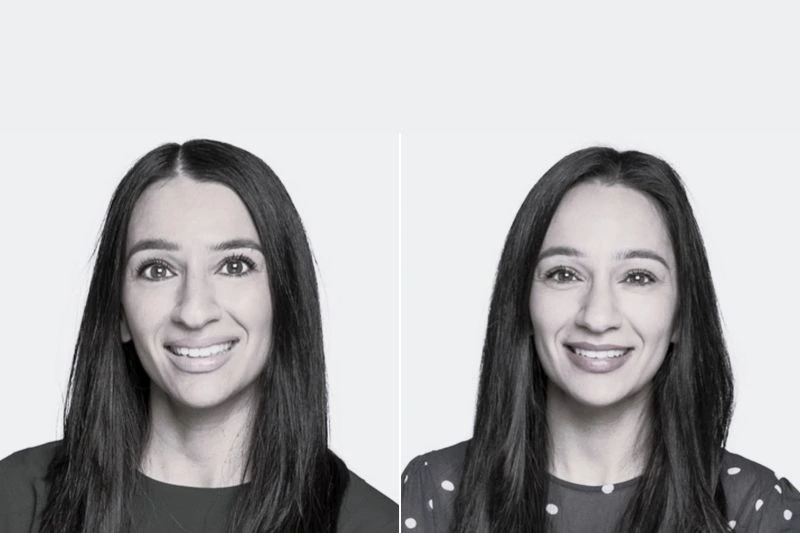

In some offices, you might overhear a familiar voice. In ours, you can sometimes hear the same one twice because there really are two. Meet Stef Falleti and Nicole Gullone, identical twins and trusted financial advisers.

It’s a common misconception that retirement marks the end of tax obligations, but income from investments, property or savings can still attract tax. Structuring your retirement income effectively, especially through superannuation, can make a significant difference to how much you keep and how far your savings go.

The potential need for assisted living is something we often avoid thinking about, but it is part of the financial planning process. Australia’s system is currently undergoing a major overhaul, with a new Aged Care Act set to take effect on 1 November 2025.