Financial security after a divorce

A divorce is a life-changing event, but it should not mean financial ruin. Financial planning and expert advice can help ease the burden.

While we specialise in financial advice, wealth management and retirement planning, we’re also here to be part of the conversation. From industry news to expert insights, practical perspectives and client updates, explore the latest articles from our team.

A divorce is a life-changing event, but it should not mean financial ruin. Financial planning and expert advice can help ease the burden.

Brad Jackson – Principal, Financial Planner. Brad has been a leading light in the financial planning industry for over thirty years.

When people first meet me, they often say, “I just want to know that I’ll be okay.” And that’s really what financial planning is about, peace of mind.

When retirement is on the horizon, many couples in Australia start thinking about the aged pension. Know how the pension is calculated.

A testamentary trust can protect your children’s inheritance from unplanned mishaps like divorce or bankruptcy.

If you’re nearing retirement or enjoying it, you will be aware of inflation’s impact on everyday life. In this article, we examine inflation in retirement and what it means for everyday Australians.

Money means different things to everyone. What feels like stability to one person might feel like a limitation to another. Our values shape daily choices and big life plans, and in a partnership, the challenge is learning how to bring two financial perspectives together.

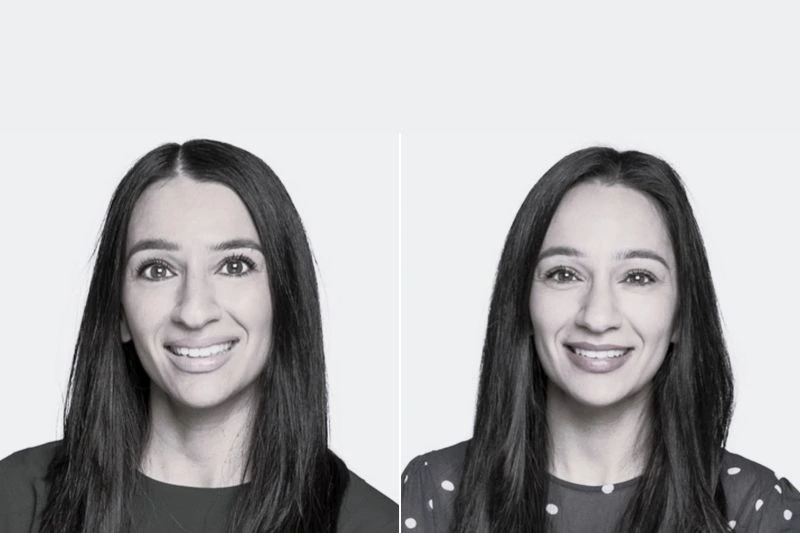

In some offices, you might overhear a familiar voice. In ours, you can sometimes hear the same one twice because there really are two. Meet Stef Falleti and Nicole Gullone, identical twins and trusted financial advisers.

It’s a common misconception that retirement marks the end of tax obligations, but income from investments, property or savings can still attract tax. Structuring your retirement income effectively, especially through superannuation, can make a significant difference to how much you keep and how far your savings go.

The potential need for assisted living is something we often avoid thinking about, but it is part of the financial planning process. Australia’s system is currently undergoing a major overhaul, with a new Aged Care Act set to take effect on 1 November 2025.